- 1. What is Capital Structure?

- Debt vs. Equity

- Leverage and Risk

- 2. The Role of Capital Structure in Corporate Finance Assignments

- Impact on Cost of Capital

- Risk Considerations

- 3. Technical Methods to Analyze Capital Structure

- Debt-to-Equity Ratio

- Interest Coverage Ratio

- 4. Evaluating Capital Structure with Industry Benchmarks

- Industry Comparison

- Cost of Capital Benchmarks

- 5. Practical Applications

- Conclusion

Understanding capital structure is a critical part of corporate finance assignments. Capital structure refers to how a corporation finances its operations and growth through different sources of funds, typically a mix of debt and equity. The mix chosen by a company influences its financial risk, profitability, and long-term sustainability. In solving assignments related to corporate finance, students are often tasked with analyzing the capital structure of a company, evaluating its effectiveness, and providing recommendations for improvements. By mastering these concepts, you can solve your corporate finance assignment more effectively, offering valuable insights into a company’s financial strategy. This blog will guide you through the steps of analyzing capital structure, from the theoretical aspects to the technical methods commonly used in corporate finance.

1. What is Capital Structure?

Before diving into analysis, it is essential to define capital structure. In finance, capital structure refers to the combination of debt and equity used by a company to fund its operations and growth. Debt includes loans, bonds, and other forms of borrowing, while equity refers to the funds raised through the issuance of stock or retained earnings. For an effective capital structure, companies must balance risk and return. Too much debt increases the risk of insolvency, while too little may limit growth opportunities. Analyzing capital structure involves understanding these dynamics and their implications for a company's financial health.

Debt vs. Equity

The two primary components of capital structure are debt and equity. Debt is borrowed money that a company must repay with interest, while equity represents ownership in the company. An important metric to consider is the debt-to-equity (D/E) ratio, which shows the relative proportion of debt and equity financing. A high D/E ratio may indicate that a company is highly leveraged, which can be risky but also potentially rewarding in terms of returns.

Leverage and Risk

Leverage refers to the use of debt to finance assets. The more debt a company takes on, the more leverage it has. Leverage amplifies both the potential returns and the risks. A highly leveraged company can generate greater returns on equity, but in times of financial distress, it can face severe difficulties in servicing its debt, leading to bankruptcy. In assignments, understanding the optimal level of leverage is key to analyzing capital structure.

2. The Role of Capital Structure in Corporate Finance Assignments

When tasked with analyzing capital structure for corporate finance assignments, students must understand its role in a company's overall financial strategy. Capital structure affects a company's cost of capital, financial risk, and ability to generate returns. Analyzing capital structure allows you to assess how well a company is managing its finances and whether its strategy aligns with its goals.

Impact on Cost of Capital

The weighted average cost of capital (WACC) is an essential tool for understanding how capital structure affects a company's cost of capital. WACC calculates the average rate of return a company must pay to finance its operations through debt and equity. Companies seek to minimize WACC, as a lower cost of capital improves profitability and shareholder value. The mix of debt and equity influences WACC, with debt typically being cheaper than equity due to tax shields (interest on debt is tax-deductible). However, increasing debt also raises financial risk, which can push the cost of equity higher.

Risk Considerations

Risk is another critical factor in analyzing capital structure. The more debt a company takes on, the greater its financial risk, as it must service this debt regardless of its financial performance. However, for firms with stable cash flows, debt can be a useful tool to amplify returns on equity. For assignments, understanding a company’s risk profile—such as its debt capacity and its ability to repay debt—is crucial in assessing whether its capital structure is optimal.

3. Technical Methods to Analyze Capital Structure

While the theoretical aspects of capital structure are important, technical methods can help you perform a more in-depth analysis in assignments. These methods involve using financial ratios, models, and calculations to assess the effectiveness of a company’s capital structure and identify areas for improvement.

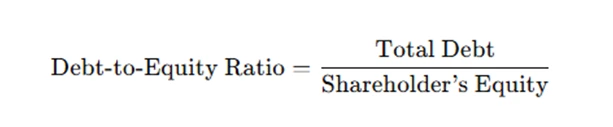

Debt-to-Equity Ratio

The debt-to-equity ratio is one of the most commonly used financial ratios to analyze capital structure. It compares the total debt of a company to its shareholders’ equity, providing insight into how much leverage the company is using. A ratio of 1 means the company has equal debt and equity, while a ratio greater than 1 means the company is more leveraged. This ratio can vary widely across industries, with capital-intensive industries typically having higher D/E ratios.

To calculate the debt-to-equity ratio:

A high ratio might suggest high financial risk, but it can also indicate a company’s reliance on debt for growth and expansion.

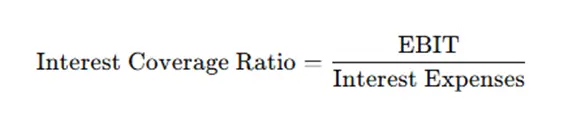

Interest Coverage Ratio

The interest coverage ratio assesses a company’s ability to meet its interest obligations on debt. This ratio compares a company's earnings before interest and taxes (EBIT) to its interest expenses. A higher ratio indicates that a company can easily cover its interest expenses, while a lower ratio signals potential trouble in servicing debt.

The formula for the interest coverage ratio is:

For assignments, evaluating this ratio helps you determine if a company’s debt levels are manageable or if it is at risk of defaulting on its obligations.

4. Evaluating Capital Structure with Industry Benchmarks

To truly assess the adequacy of a company’s capital structure, it’s essential to compare its metrics with industry benchmarks. Each industry has its unique capital structure characteristics, and comparing a company’s ratios with its peers can provide valuable insights into its financial strategy. In your assignments, consider how a company stacks up against its competitors and whether its capital structure is in line with industry norms.

Industry Comparison

Comparing a company's capital structure to that of its competitors allows you to identify whether the company is over-leveraged or under-leveraged. For example, a tech company with a debt-to-equity ratio of 0.5 might be considered under-leveraged, given the low capital intensity of the industry. However, a manufacturing company with the same ratio might be seen as being conservative in its financial strategy. Analyzing capital structure relative to industry peers provides context and helps you understand the company’s financial positioning.

Cost of Capital Benchmarks

In assignments, you should also consider the cost of capital when analyzing capital structure. If a company’s WACC is significantly higher than the industry average, it may suggest that its capital structure is inefficient. This could be due to excessive debt or a high proportion of equity, both of which can impact profitability and growth. By benchmarking a company’s WACC against industry averages, you can provide recommendations for optimizing the capital structure.

5. Practical Applications

Analyzing capital structure is not just about calculating ratios; it also involves understanding how these ratios impact the company’s operations and financial strategy. By applying financial metrics such as the debt-to-equity ratio and interest coverage ratio, you can assess a company’s ability to manage its debt and equity effectively. The debt-to-equity ratio, for instance, provides a clear picture of how much leverage a company is using, while the interest coverage ratio helps to understand the company’s ability to meet its debt obligations. These technical tools are essential for offering actionable insights in corporate finance assignments, as they help to determine the financial stability and long-term viability of the business.

In your analysis, it’s also crucial to evaluate a company’s capital structure in the context of its industry. By comparing the company’s ratios to industry benchmarks, you can better assess whether the company is under-leveraged or over-leveraged compared to its peers. This benchmarking process provides more context for your conclusions, offering a well-rounded perspective on the company’s financial health. It helps to reveal if the company’s capital structure aligns with industry standards or if there are significant discrepancies that could affect its performance in the market.

Another practical aspect of analyzing capital structure involves assessing the company’s overall financial strategy. Companies with well-structured capital often enjoy lower costs of capital, which can lead to higher profitability and competitive advantages. Conversely, inefficient capital structures can increase the company’s cost of capital, reducing profitability and possibly limiting growth. In your corporate finance assignments, consider the long-term effects of the company’s financing decisions and how they align with its strategic goals.

Moreover, the risk associated with a company’s capital structure is a key factor to explore in your assignments. High levels of debt can increase the company’s financial risk, making it more susceptible to market volatility and economic downturns. By evaluating the company’s financial leverage, you can offer recommendations for balancing debt and equity to reduce risk without sacrificing growth opportunities. Risk management is a critical part of corporate finance, and assessing the company’s capital structure helps you identify potential vulnerabilities in its financial strategy.

Lastly, in analyzing capital structure for your assignments, it’s essential to recognize the broader implications of financing decisions. A company’s capital structure not only influences its financial performance but also its market perception and investor confidence. By demonstrating an understanding of these broader implications, you will provide a comprehensive analysis that reflects the interconnectedness of financial strategies and business outcomes.

Conclusion

In conclusion, analyzing capital structure is a fundamental aspect of corporate finance, requiring both theoretical knowledge and practical application. For students tackling corporate finance assignments, understanding the components of capital structure—such as debt and equity—is crucial for evaluating the financial health of a company. By using financial ratios like the debt-to-equity ratio and interest coverage ratio, you can assess the company’s level of financial leverage, its ability to meet debt obligations, and its overall risk exposure. If you need help with finance assignment, mastering these concepts will guide you in delivering well-informed and accurate analyses.

Additionally, comparing a company’s capital structure to industry benchmarks provides valuable context, helping to determine if the company’s financial strategy aligns with industry standards. This, combined with a thorough understanding of cost of capital, risk considerations, and the company’s long-term strategy, allows for a well-rounded analysis. Ultimately, the goal is to evaluate whether a company’s capital structure is optimal and offer recommendations for improving financial performance and reducing risk. By following these steps, students can gain a deeper understanding of corporate finance and enhance their ability to tackle assignments effectively.